With a team of fully qualified experts, we deliver high-level tax advice and solutions tailored to your business needs.

Our Core Services

Company Accounts

Annual accounts preparation for your business and submission to Companies House. Statutory book maintenance.

Explore Company AccountsSole Trader

We offer comprehensive Sole Trader Services to help individuals manage their finances, stay compliant with HMRC, and grow their businesses.

Explore Sole TraderSelf Assessment

Preparation and submission of self assessment forms to HMRC, capital gains tax, pension tapering advice.

Explore Self AssessmentVAT Returns

VAT return preparation and submission to HMRC. VAT guidance and advice for registration.

Explore VAT ReturnsCorporation Tax

Preparation & submission of corporation tax returns (CT600) to HMRC. Also advise on how to maximise tax savings.

Explore Corporation TaxPayroll

We prepare Payslips, P60s and everything payroll related. We also give advice on what the most tax efficient salary is.

Explore PayrollOur Business Advisory Services

Sustainability Strategy & Compliance

We help businesses integrate sustainability into their core strategies, ensuring alignment with corporate goals and regulatory requirements.

Explore SustainabilityVirtual CFO

We offer expert Chief Financial Officer (CFO) Services to help businesses make informed financial decisions, optimise their financial performance, and drive sustainable growth.

Explore Virtual CFOBusiness Plans

We provide expert Business Plan Services to help businesses of all sizes build clear, actionable plans for success.

Explore Business PlansReady to start?

Get StartedUp-to-date insights on UK tax legislation.

Personalized tax strategies for your business.

Ensuring compliance while optimizing tax savings.

General FAQs

We support a wide range of businesses, from startups and sole traders to SMEs and larger corporations, across various industries in the UK.

In addition to traditional accounting, we provide Corporation Tax Services, Sustainability Strategy & Compliance, bookkeeping, payroll, VAT returns, and business advisory services.

We ensure your business meets all UK tax obligations by handling tax returns, offering tax planning strategies, and keeping you updated on regulatory changes.

Yes, we help businesses align their financial strategies with sustainability goals, ensuring compliance with ESG (Environmental Social Governance) regulations and reporting standards.

You can contact us via our website or phone to schedule a consultation. We will discuss your needs and tailor our services to support your business effectively.

While we aim to cover all questions in our FAQ, obviously it is impossible. Therefore, for ease of knowledge, we would advise you to book a meeting with us.

Book a meeting

We got some great accounting tips for you!

October 30, 2025

October 30, 2025

How to make tax digital (mtd) in 2025?

The UK tax system is undergoing a major transformation through Making Tax Digital (MTD), HMRC’s initiative to make tax administration more effective, efficient, and easier for taxpayers. While the changes bring long-term benefits, they also create new responsibilities for businesses, landlords, and individuals.

Continue reading August 25, 2025

August 25, 2025

How to Calculate Your Carbon Footprint in 2025: A Practical 4-Step Guide for Businesses

Calculating your company’s carbon footprint is the process of measuring all greenhouse gas emissions from your business activities.

Continue reading August 19, 2025

August 19, 2025

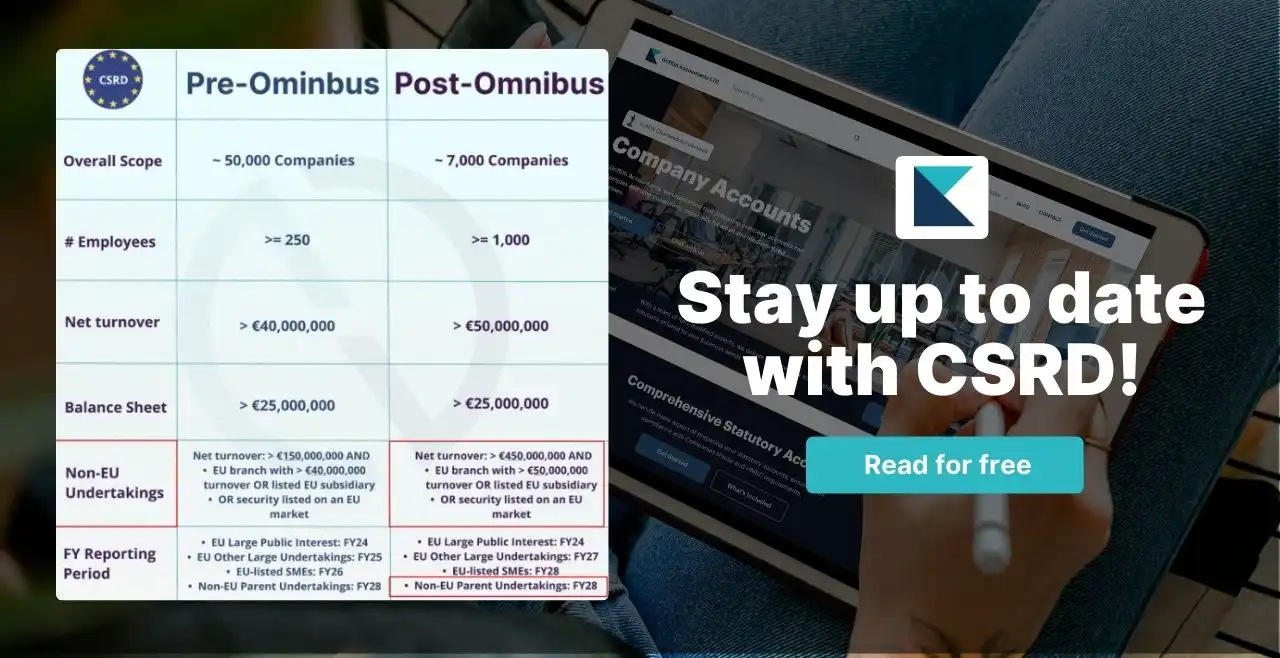

Sustainability Reporting in the UK & EU: What Small Businesses Need to Know

Learn how the EU CSRD and UK sustainability reporting rules affect small businesses, and how to prepare for future reporting requirements.

Continue reading July 12, 2025

July 12, 2025

Sustainability Finance in the UK & EU: Why It’s Critical for Business Growth

As sustainability finance climbs the corporate agenda, businesses across the UK and EU are under increasing pressure to align with environmental and social goals. But this shift isn’t just about compliance it’s about opportunity.

Continue reading March 25, 2025

March 25, 2025

Accountant for Uber Drivers

If you’re an Uber driver in the UK, you might be wondering: do Uber drivers need an accountant? The short answer is no, you are not legally required to hire an accountant. But let’s dig a little deeper into why having one could make a big difference in your driving gig.

Continue reading March 25, 2025

March 25, 2025

Company Accounts Bookkeeping Importance

Whether you’re a small business owner or running a larger enterprise, keeping accurate company accounts is vital for legal compliance, financial decision-making, and overall business success.

Continue reading March 25, 2025

March 25, 2025

Financial Statements in the UK

Every company, whether it’s a start-up or a well-established enterprise, relies on four essential financial statements to monitor its financial health and overall company accounts.

Continue reading March 25, 2025

March 25, 2025

Company Accounts Audit – Best Practices

Thinking about an audit can make you feel nervous. The word ‘audit’ might remind you of lots of paperwork and being checked closely. But, audits are important for checking if your company’s money is in order.

Continue reading March 18, 2025

March 18, 2025

Company Accounts for Business

Understanding company accounts can be tricky, especially if you’re just starting out. The rules around filing and financial statements can feel overwhelming. But getting a handle on your company’s finances is vital for staying compliant and growing your business.

Continue reading March 18, 2025

March 18, 2025

Amazon Sellers VAT Updates

Amazon updated its VAT policy for UK sellers, transitioning fee billing from Amazon Services Europe S.à r.l. (Luxembourg) to a UK entity. This means all Amazon fees—including subscription fees, FBA fees, and referral fees—are now subject to the 20% VAT rate in the UK.

Continue readingAccounting Done For You

Everything you need to know regarding your company accounts will be covered in our preliminary discussion with your or your team.

Please wait while Calendly meeting scheduler load.